Can I afford to hire another labourer?

A simple Excel tool that shows the cash risk of hiring — before you commit.

This is not a forecast or growth model. It isolates the incremental risk of adding a fixed cost.

Click “View the tool (Read Only)” above to download a read-only example and open it in Excel.

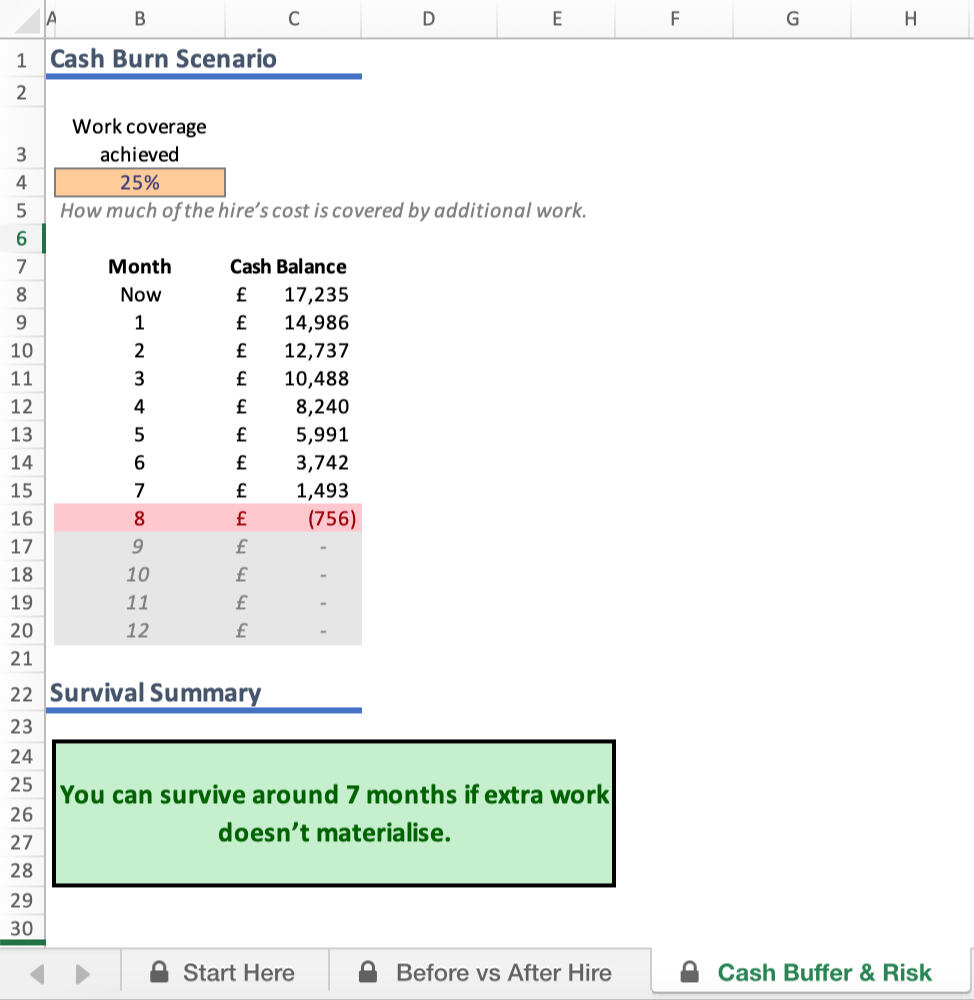

Example output showing cash runway if additional work only partly materialises.

A simple Excel tool that shows the cash risk of hiring — before you commit.

Hiring feels like the obvious next step.What’s less obvious is how much cash risk you’re taking on if the work doesn’t land as expected.This tool answers one question, clearly:

If I hire someone and the extra work doesn’t fully materialise, how long can my business survive?

What This Tool Does (and Doesn’t)

This is not:

a profit forecast

a growth model

a P&L

a “what if everything goes right” calculator

It is a risk filter.It isolates the incremental impact of adding one fixed monthly cost — a new hire — and shows what that does to your cash runway.

Who is this tool for

This tool is designed for:

UK trades and small service businesses

Owners thinking about their first or next hire

Anyone asking: “Am I being sensible — or am I betting the business?”

You don’t need accounting knowledge.You just need to know roughly what comes in, what goes out, and what a new hire really costs.

How it works - High level

You enter:

your current cash balance

your average monthly income and overheads

what a new hire would actually cost per month

The tool then shows:

what changes because of the hire

how quickly cash would fall if extra work doesn’t show up

how long you can carry that risk without hurting the business

Nothing more. Nothing hidden.

The key insight

Hiring doesn’t fail because the numbers were wrong.

It fails because owners quietly assume:

“The work will probably be there.”

This tool doesn’t assume success.It asks:

“What happens if this only half works?”

You can see:

worst-case (no extra work)

partial coverage

full cost coverage

All through a cash-only lens.

What Makes This Different

Incremental, not theoretical

It looks only at what changes when you add the hire — not the whole business.

Conservative by design

Upside is deliberately ignored.

If it does better than break-even, that’s a bonus — not something you rely on.

Cash-focused

Monthly cash survivability matters more than annual profit.

Accountant-safe

Assumptions are stated.

No clever tax tricks.

No hidden optimism.

What You’ll See Inside

You can see:

Clear inputs (no clutter)

Month-by-month cash runway

A single decision summary that tells you:

how much work needs to materialise

how long you can afford to wait if it doesn’t

No charts to impress.

No scenarios to game.

Just the answer you need.

What This Tool Will Not Tell You

It will not tell you:

whether to hire

how to grow faster

how much profit you’ll make

how to optimise tax

It shows the conditions under which hiring is financially safe — and lets you decide.

Price

£149 — one-off.

No subscription.

No upsell.

No bundled tools.

You’re paying for clarity, not software.

Final thought

Most hiring mistakes aren’t reckless — they’re optimistic.This tool is for owners who want to grow without gambling the business.

This website uses analytics to understand visitor behaviour.